Since the beginning of 2024, Bitcoin (BTC) price has continuously broken its all-time high (ATH) with record trading activities and volume. Recently, this digital gold has just set a new record, breaking the latest all-time high (ATH) to almost reach $110,000, marking an over 330% increase.

Bitcoin ETFs also saw record net inflows as investors poured their money in, and many institutions & countries are taking steps to build their Strategic Bitcoin Reserves, further consolidating Bitcoin position & bullish market sentiment.

This post will delve deep into the fundamental price analysis of Bitcoin BTC and affecting factors to give a Bitcoin price prediction 2025.

Bitcoin Technical Analysis

To conduct comprehensive Bitcoin price predictions, it’s necessary to fully grasp the coin’s historical price movement and some technical indicators.

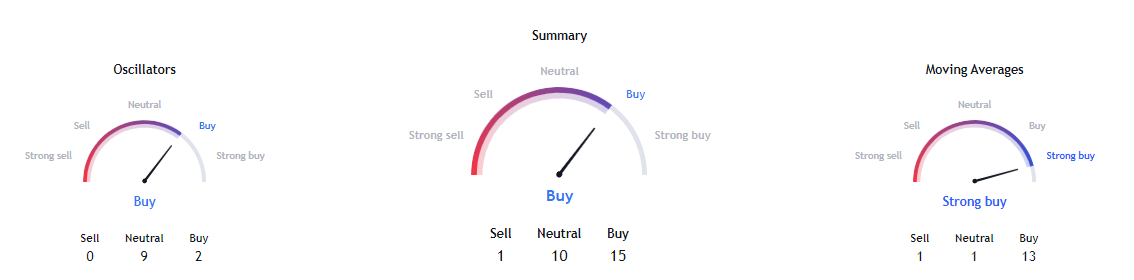

- Moving Average

Looking at the Moving Averages of BTC, all of the indexes are now sloping up and below the current price. Important MAs such as the 50-day and 200-day indicators both point to a Strong Buy sentiment. This also implies that if the BTC price interacts with these numbers again, they could act as a support to continue the trend.

- Relative Strength Index

Currently, the RSI remains in neutral range at 61, meaning that the price is trending overbought and could keep RSI in that start for a while.

- MACD

As the histogram shows, there is currently a bearish divergence, implying that the Bitcoin price is going the reverse, and investors may persist with their actions to Buy.

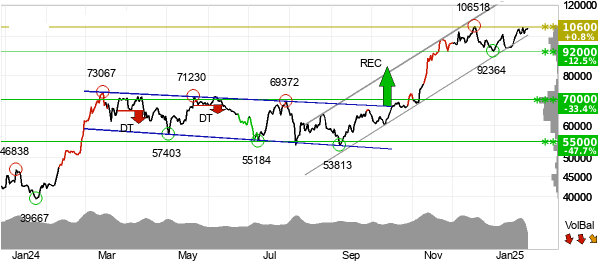

Bitcoin Price Analysis

Bitcoin is encountering resistance near the key psychological level of $110,000. However, the price holding above the uptrend line is a positive indicator. As seen in technical indicators, the upward-sloping 20-day exponential Moving Average (EMA) at $92,114 and the Relative Strength Index (RSI) in positive territory suggest that bulls are in control. This implies that the chances of a breakout above the $100K mark are quite high. If successful, the BTC/USDT pair could rally to $113,331 and potentially set a new all-time high (ATH) of $125,000.

To note, for sellers to weaken the bullish momentum of BTC price, they need to push the price below the 20-day EMA, which might then drop the pair to $85,000, but this could attract new buying interests.

Moreover, we can see that BTC price has broken out of a horizontal trend channel in the medium long term. This signals a continued strong development, and the currency now finds potential support at the upper boundary of the trend channel during any pullbacks.

Since breaking resistance at $67,241 from a rectangle formation, the Bitcoin price has surged astonishingly to reach the initial target of $84,547, suggesting additional gains. However, in case of a downward correction, support is expected to be around the 70,000 level. The currency is testing resistance at point 106,000. Overall, Bitcoin is now neutral for the medium-to-long term.

Bitcoin (BTC) Price Prediction 2025

In the Bitcoin price prediction 2025, Bitcoin is forecasted to continue its bullish momentum. The “digital gold” is expected to be traded between $98,213 and $177,384. On average, BTC is expected to change hands at $ 132,581 during the year. The most bullish month for BTC could be August, when the currency is anticipated to trade 86.31% higher than today.

However, as the new Trump’s administration is taking over the White House, there are still surprising factors that could fuel the Bitcoin price. Fundstrat Co-Founder Tom Lee even predicts that #Bitcoin will hit $250K by next Thanksgiving. Cardano founder Charles Hoskinson predicts #Bitcoin could reach $500,000 in two years, driven by #DeFi growth and increased government adoption.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| January | $ 105,727 | $ 111,907 | $ 123,260 | 29.72% |

| February | $ 99,474 | $ 105,468 | $ 113,639 | 19.59% |

| March | $ 98,213 | $ 110,385 | $ 118,580 | 24.79% |

| April | $ 117,062 | $ 129,854 | $ 136,773 | 43.94% |

| May | $ 133,255 | $ 144,034 | $ 160,978 | 69.41% |

| June | $ 157,638 | $ 163,179 | $ 169,231 | 78.10% |

| July | $ 156,826 | $ 166,815 | $ 174,299 | 83.43% |

| August | $ 155,920 | $ 168,119 | $ 177,384 | 86.68% |

| September | $ 140,171 | $ 144,662 | $ 156,809 | 65.03% |

| October | $ 115,867 | $ 124,831 | $ 138,167 | 45.41% |

| November | $ 110,290 | $ 112,299 | $ 115,435 | 21.49% |

| December | $ 104,997 | $ 109,422 | $ 111,812 | 17.67% |

Conclusion

According to the Bitcoin price prediction 2025, the Bitcoin market continues to surpass expectations, driven by Bitcoin’s remarkable performance and achievement of significant milestones. As adoption grows among institutions, governments, and retail investors, Bitcoin is forecasted to reach new all-time highs (ATHs). Projections suggest an average price of $132,581, with a potential maximum of $177,384 in 2025. While volatility and external factors such as geopolitical shifts remain potential challenges, the bullish sentiment surrounding Bitcoin indicates a promising future for this digital asset.