According to Emerging Portfolio Fund Research (EPFR), the banking crisis has caused many investors to rebalance their portfolios over the past two weeks. So far in March, over $286 billion has been moved into U.S. money market funds.

According to the data, Goldman Sachs, JPMorgan Chase, and Fidelity have benefited the most from the influx of capital into U.S. money market funds over the past two weeks. Goldman Sachs’ money market funds received $52 billion, a 13% increase, while JPMorgan’s funds received nearly $46 billion, and Fidelity received almost $37 billion. Since the COVID-19 epidemic, the volume of arrivals has been at its highest level in a month.

A money market fund typically provides investors with high liquidity and low risk, making them a popular choice during uncertain times. As the Federal Reserve continues to raise interest rates to fight inflation, these funds offer their best yields in years.

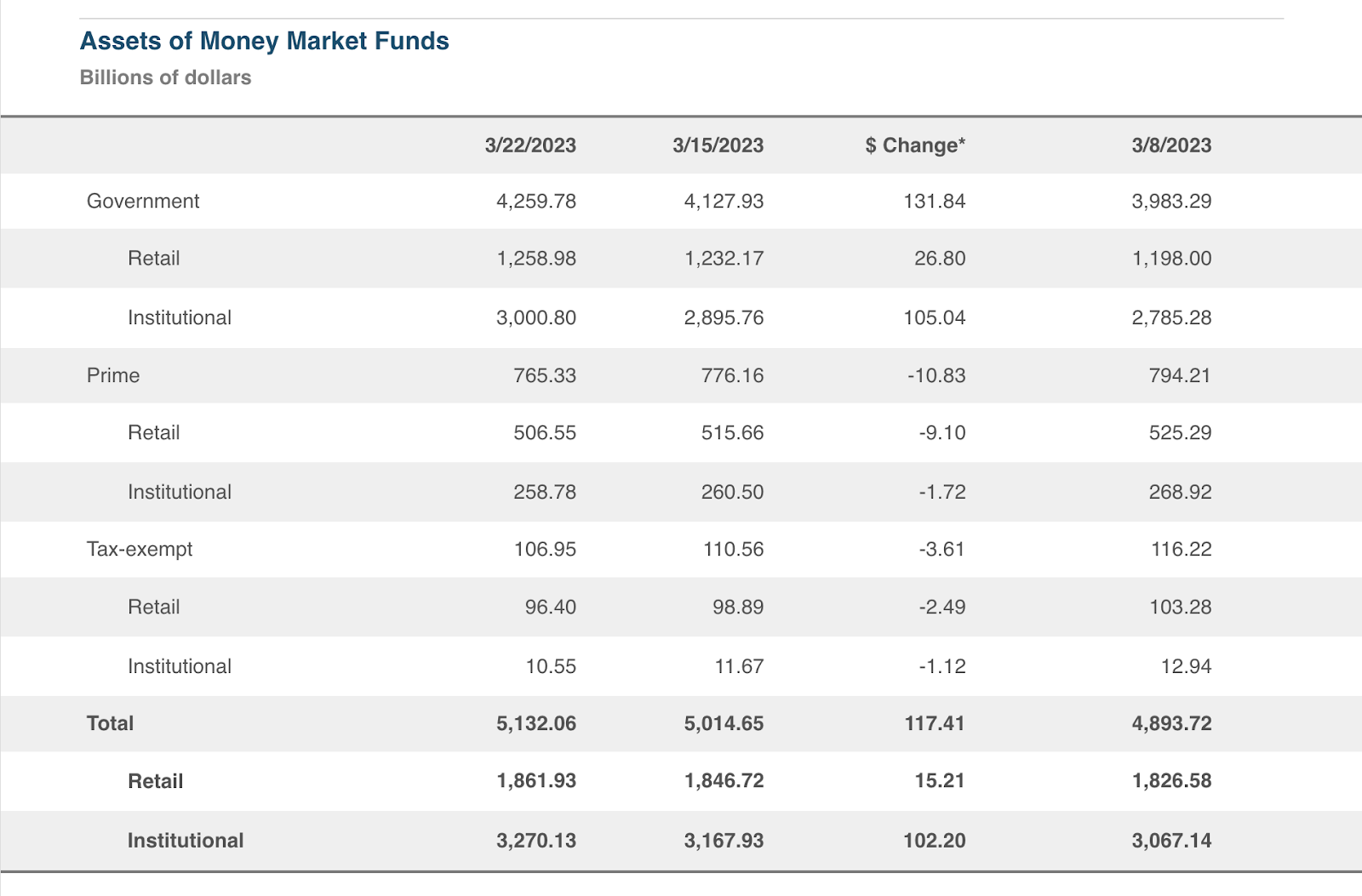

According to the Investment Company Institute, market fund assets increased by $117.42 billion to $5.13 trillion in the week ending March 22. Government money market funds increased by $131.84 billion, while prime funds decreased by $10.83 billion. The decline in tax-exempt money market funds was $3.61 billion.

Money flows into money market funds amid concerns about the financial system’s health as U.S. and European institutions run out of cash because of tightening monetary policy.

Due to a rise in the cost of insuring against Deutsche Bank’s prospective default risk, its stock price declined on March 24. Reuters used S&P Global Market Intelligence data to report that the German bank’s five-year credit default swaps (CDS) increased by 19 basis points (bps) from the day before to 222 bps.

In the United States, ambiguity still looms over regional banks as insurance on default for financial services firms Charles Schwab and Capital One skyrocketed last week, with credit default swaps increasing by over 80% to 103 basis points as of March 20.

BREAKING: Credit Default Swaps (CDS), insurance on default on Charles Schwab EXPLODE 😱🚨 pic.twitter.com/KJdNTq2xMm

— Bitcoin News ⚡ (@BitcoinNewsCom) March 24, 2023